#QuickbiteCompliance day 288

Unmasking U-Turn Payments: The Hidden Highways of Sanction Evasion

As financial crime fighters, we often encounter complex schemes designed to bypass controls. Among these, U-Turn transactions stand out for their deceptive simplicity and global impact. Here’s what you need to know:

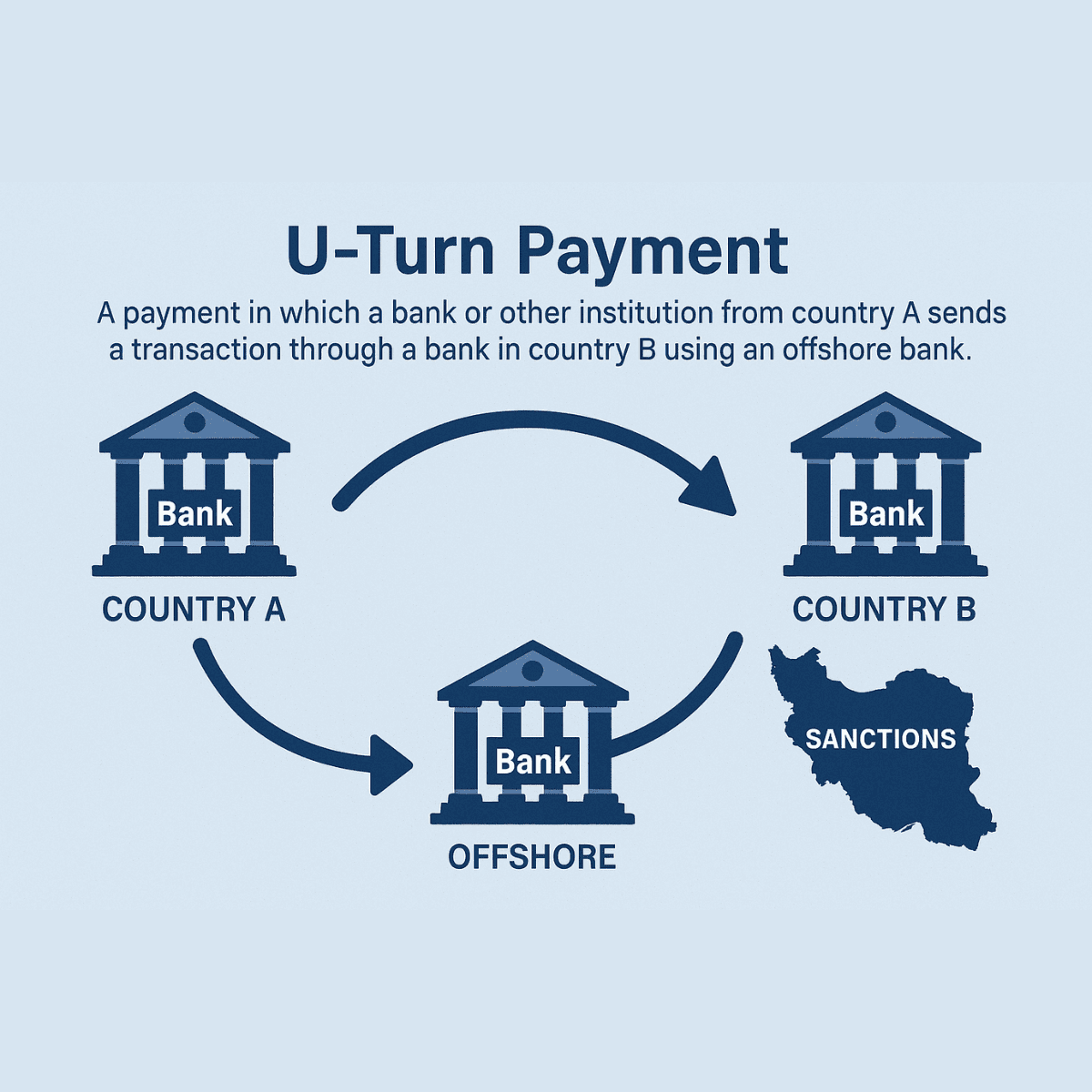

### 🔍 What Are U-Turn Payments?

A U-Turn payment occurs when a bank in Country A sends a transaction through an offshore bank (e.g., Switzerland) to a bank in sanctioned Country B (e.g., Iran), exploiting the U.S. financial system as a “turnstile.” Funds enter a U.S. bank and instantly exit to a non-Iranian foreign bank, creating a “U” path . This loophole historically allowed Iranian entities to process USD transactions despite sanctions—until OFAC banned it in 2008 .

### ⚠️ How Bad Actors Exploit U-Turns Today

While banned for Iran, the tactic persists globally. Criminals adapt it to:

1. Evade Russian Sanctions : Funds move via non-sanctioned/non-NATO jurisdictions (e.g., through Turkey or UAE), masking ultimate destinations .

2. Disguise Oil Trade : Iranian oil payments were routed through European banks via “currency conversion hubs,” obscuring origin/destination with incomplete payment info .

3. Layer Illicit Funds : Multiple banks across jurisdictions fragment audit trails. E.g., Bank A (Russia) → Bank B (Armenia) → Bank C (UAE) → U.S. bank → return to Bank A’s offshore subsidiary .

### 🚩 Key Red Flags for Detection

– “Carouseling” : Funds received from Country X are immediately remitted back to the same country or a linked entity .

– Mismatched Documentation : Invoices/contracts inconsistent with transaction paths (e.g., “consulting fees” for oil shipments) .

– Offshore Shell Companies : Beneficiaries hidden behind entities in secrecy havens .

– Velocity Over Volume : Low account balances despite high-volume, rapid pass-through activity .

### 💡 How Tech Fights Back

#InclusiveRegtech and #OpenSourceAML tools are critical to dismantling these schemes:

– AI-Pattern Recognition : Flags “U-Turn” velocity (e.g., same-day in/out transfers) and links to high-risk jurisdictions.

– Network Analytics : Maps hidden relationships between shell companies and sanctioned entities.

– Collaborative Databases : Shared typologies (e.g., common “gateway” banks) boost cross-institutional detection.

🛡️ The Bottom Line : U-Turn tactics evolve, but so does our arsenal. By prioritizing transaction context (not just compliance checkboxes) and investing in adaptive tech, we can close these hidden highways.

Keen to dive deeper? Explore the [ ACAMS AML Glossary ](https://www.acams.org/en/resources/aml-glossary-of-terms) for terms like “stripping” and “cover payments.”

#FinancialCrime #SanctionsCompliance #AML #UTurnPayments #TransactionMonitoring #RegTech #InclusiveRegtech #OpenSourceAML #100HariNulis #SanctionEvasion #ComplianceInnovation