#QuickbiteCompliance day 282

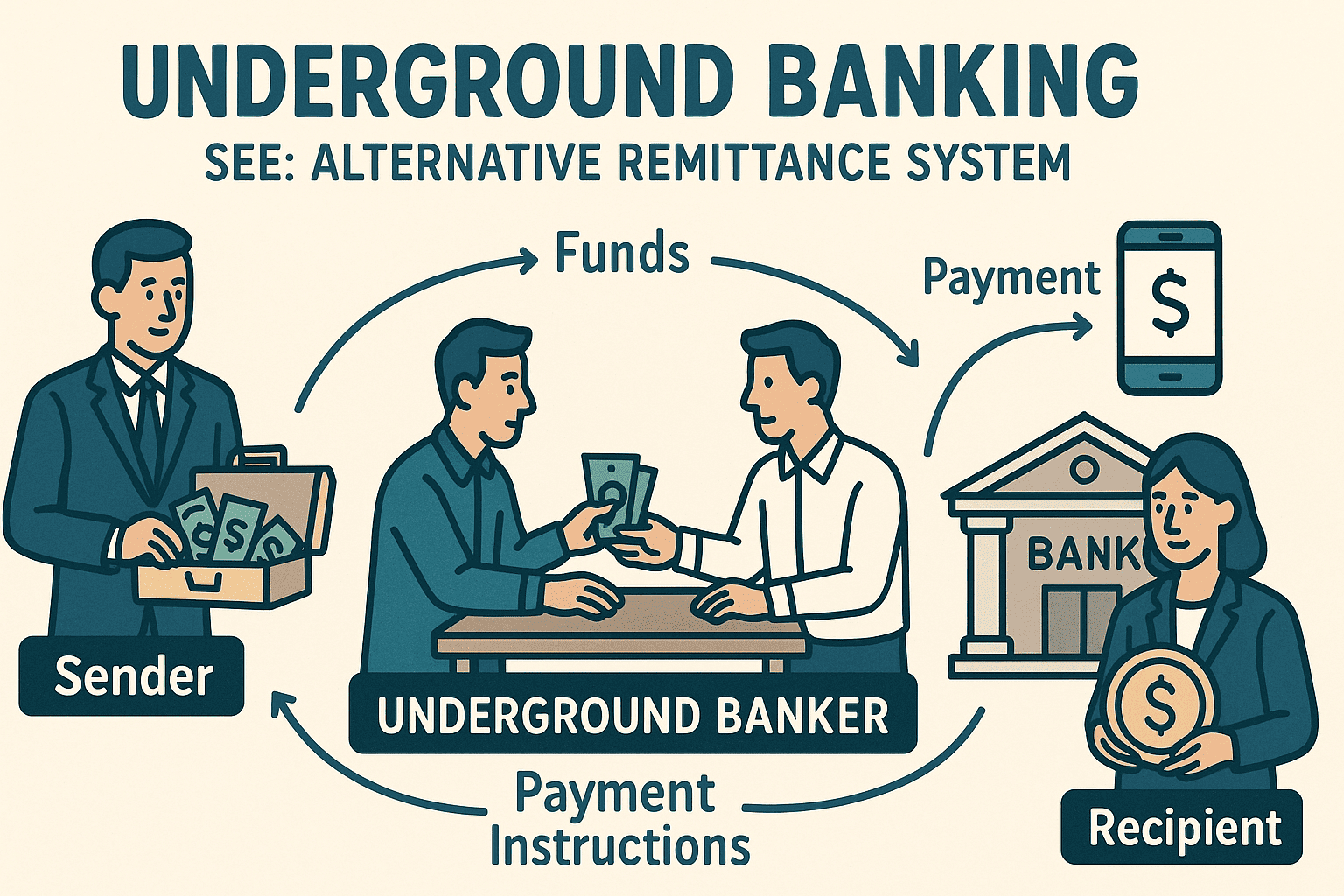

Underground Banking: The Invisible Highway for Financial Crime

While traditional banking systems dominate headlines, a parallel financial universe operates in the shadows. Underground Banking—or Alternative Remittance Systems (ARS)—facilitates $500B+ in global transactions annually, often legally serving migrant communities. Yet, its anonymity and lack of oversight make it a magnet for criminals. Here’s how bad actors exploit it:

### ⚠️ How Criminals Hijack Informal Networks

1. Terrorist Financing :

– Hawala networks enabled Al-Qaeda’s 9/11 attacks by moving funds undetected. Trust-based transactions leave no paper trail, evading sanctions screening .

2. Drug & Arms Trafficking :

– Mexican cartels use físicos (cash couriers) to move USD into ARS, converting drug profits into “clean” funds via trade-based schemes like over-invoiced exports .

3. Tax Evasion & Capital Flight :

– China’s $50K foreign-transfer cap is bypassed via “smurfing”—splitting large sums among family members. Funds reemerge in UK property markets, obscuring origins .

4. Trade-Based Money Laundering (TBML) :

– Fake invoices for phantom shipments (e.g., “exported” luxury goods) settle Hawala debts, layering illicit funds into legal commerce .

—

### 🔍 The Compliance Blind Spot

ARS thrives where regulation lags:

– No Cross-Border Movement : Value transfers occur via ledger offsets—no wires = no visibility .

– Community Trust > KYC : Hawaladars rely on kinship networks, not ID verification .

– Digital Evolution : Crypto-P2P apps now mimic Hawala, using stablecoins to bypass FX controls .

FATF’s Special Recommendation VI demands ARS licensing, but New Zealand’s unregulated fei ch’ien networks show enforcement gaps persist .

—

### 💡 Fighting Back: Inclusive RegTech Solutions

To combat abuse without excluding vulnerable communities:

– AI-Powered Typology Mapping : Machine learning detects “smurfing” patterns (e.g., 20+ $4,950 deposits) across MTOs .

– Blockchain Analytics : Track crypto-IVTS hybrids laundering via privacy coins .

– Low-Cost Digital KYC : Biometric IDs for hawaladar clients, integrated with public registries .

> “Banning informal systems fuels opacity; regulating them brings transparency.”

—

#InclusiveRegtech bridges compliance and financial inclusion. #OpenSourceAML tools like decentralized transaction screeners can shine light on this shadow economy. Let’s innovate to protect—not punish—legitimate users.

Sources :

– [ACAMS AML Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

– [FATF on Alternative Remittance](https://www.fatf-gafi.org/)

#FinancialCrime #Hawala #AntiMoneyLaundering #FinTech #Compliance #100HariNulis #RegulatoryTechnology #ShadowBanking