#QuickbiteCompliance day 278

Unlocking the “Secret Treasure Box”: How Bad Guys Hide Money in Trusts (And How We Stop Them)

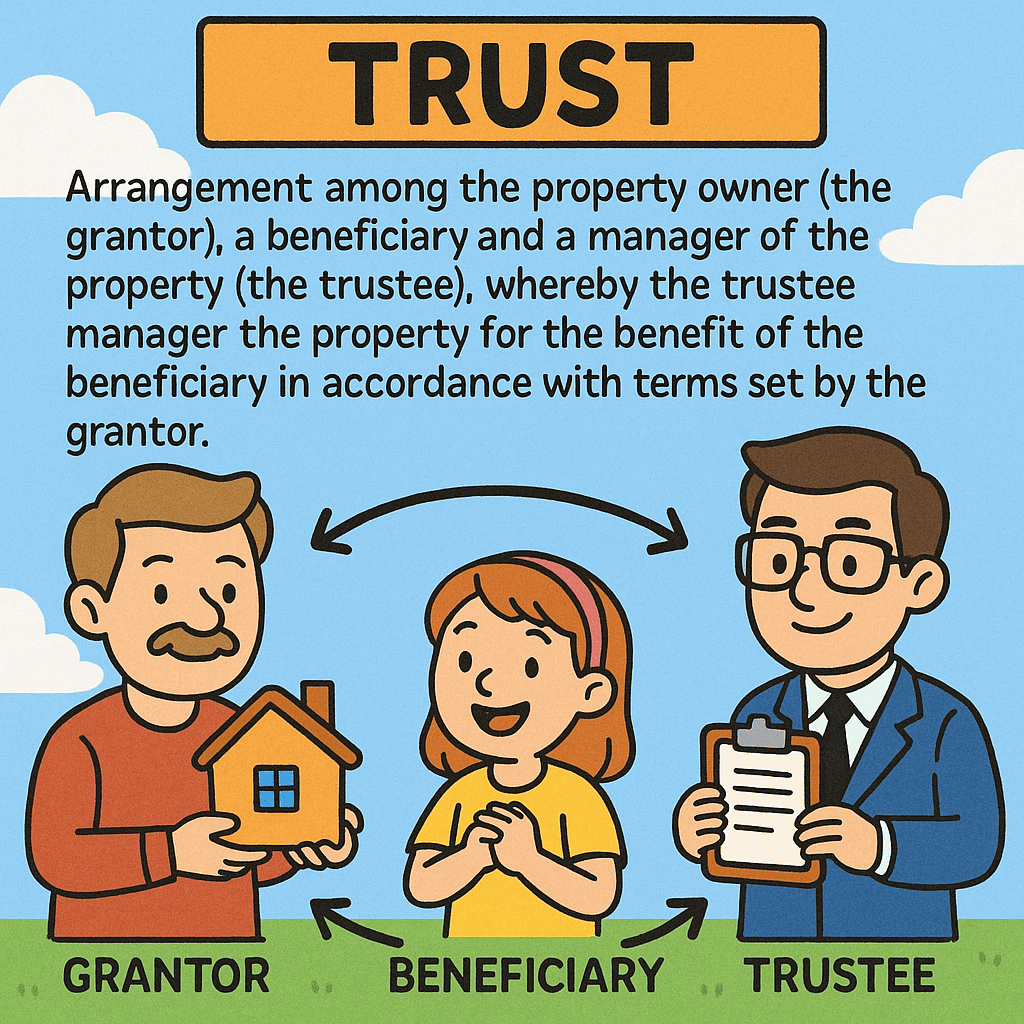

Imagine giving your toy box to a friend to manage. They promise to share toys with other friends only when you say so. That’s a trust in simple terms! 😊

➡️ Grantor: You (who owns the toys).

➡️ Trustee: Your friend (manages the toys).

➡️ Beneficiary: Friends who get toys.

But sometimes, bad guys use this “toy box” to hide stolen treasures. Here’s how:

### 🚨 Real-Life Spy Games

1. The Hidden Palace:

A Russian oligarch’s partner hid a £61M London apartment in a trust. The trustee’s name was public, but the real owner was secret. French authorities froze similar properties—but the UK didn’t catch it in time .

2. Ghost Beneficiaries:

Criminals set up trusts with fake beneficiaries (e.g., “ABC Family Trust”). The trustee moves dirty money globally, while the true owner (a drug lord or corrupt leader) stays invisible .

3. Layers of Lies:

In Singapore, criminals used trusts to “wash” $1B+ from scams. They bought mansions and gold—all under trustee names, masking their identities until police unraveled the web .

—

### 🔍 Why Trusts Are a Criminal’s Best Friend

– Secrecy: Trustees’ names are public, but beneficiaries stay hidden .

– No Paper Trail: Trusts can own shell companies, making money seem “clean” when it’s not .

– Global Hideouts: Offshore trusts in tax havens (like Cayman Islands) ignore police requests .

> 💡 Did you know?

> 236,500+ UK properties worth £64B are owned by secretive trusts—some tied to terrorists or corrupt politicians .

—

### ⚔️ Fighting Back: Tech + Teamwork

1. “X-Ray Vision” Regtech:

Tools like AI-powered network analysis scan millions of transactions to spot hidden trust links (e.g., a trustee moving money to a sanctioned politician’s cousin) .

2. Open-Source Intelligence:

Investigators share data on shady trusts globally. Example: The Fintel Alliance in Australia used open algorithms to bust a $40M art-money-laundering ring .

3. Beneficiary “Flashlights”:

New laws (like China’s 2025 AML rules) force trusts to reveal true owners—no more shadows .

—

### 🌍 Join the Movement!

We’re using #InclusiveRegtech to make tools affordable for small banks and #OpenSourceAML to share crime-fighting code. Together, we turn secrecy into transparency ✨.

👉 Swipe through this carousel for more examples!

[ACAMS Glossary: Trusts Explained](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrimePrevention #AntiMoneyLaundering #TrustTransparency #100HariNulis #SanctionsCompliance #PublicPrivatePartnerships #FollowTheMoney

—

💬 Your thoughts? How else can we expose hidden trust abuses? Share below!