#QuickbiteCompliance day 273

🔍 The Sneaky World of Trade Fraud: How Crooks Abuse Letters of Credit (and How We Stop Them)

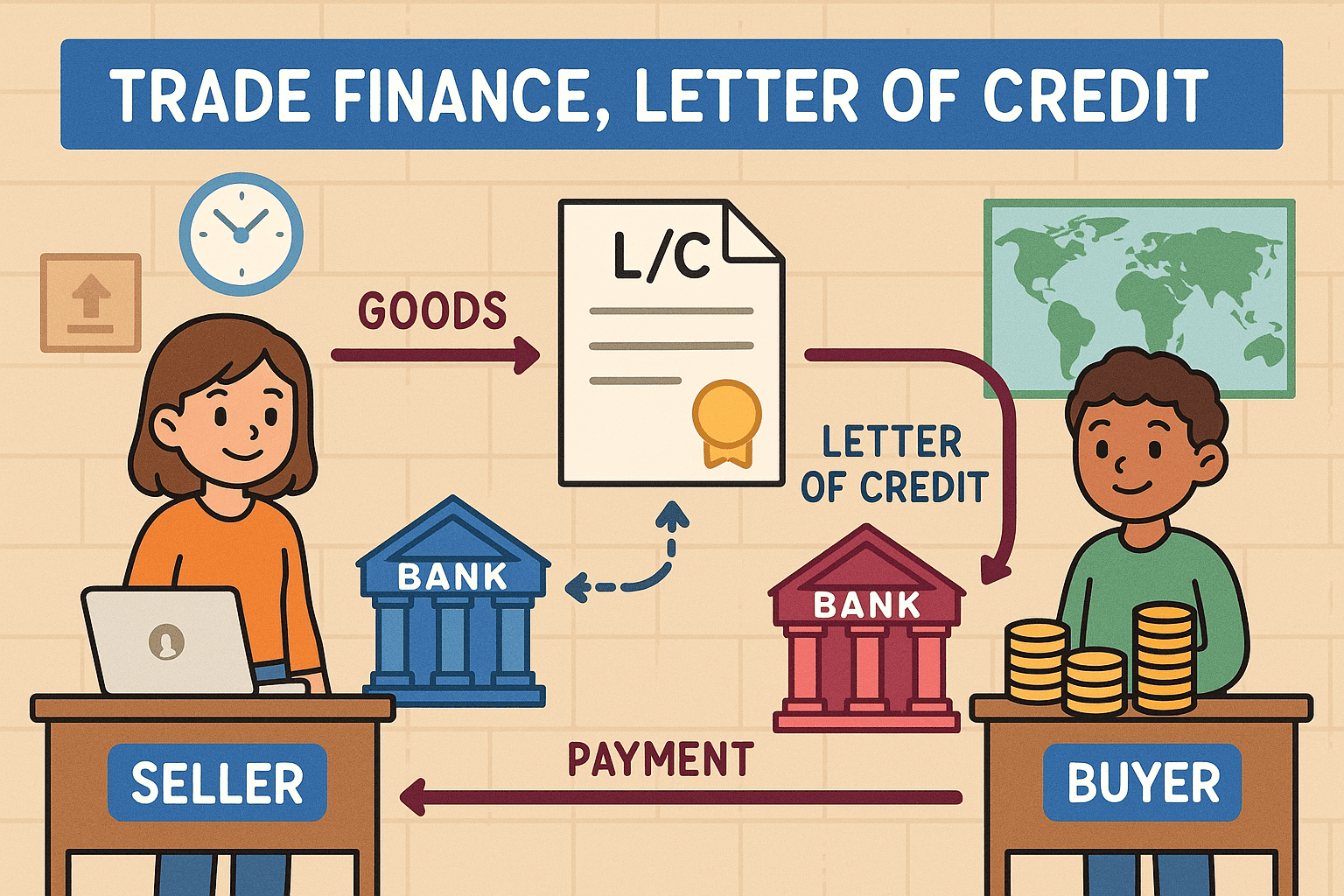

Imagine a “money passport” called a Letter of Credit (LC). Banks issue it to guarantee a buyer pays a seller—if the seller shows proof (like shipping documents) that goods were sent. Sounds safe? Crooks have turned this system into a playground for scams. Here’s how ⚠️:

### 🚨 5 Simple Ways Bad Guys Trick the System

1. Fake Shipments, Real Cash

Fraudsters present forged bills of lading (shipping receipts) for cargo that doesn’t exist. Banks pay because documents look perfect—even if the goods are imaginary! In the “Solo Industries” scam, this cost banks $500 million .

2. The “Double-Dip” Warehouse

In China’s Qingdao scandal, a metals trader used the same cargo as collateral for loans from multiple banks. When the fraud collapsed, banks lost $4.5 billion .

3. Cloned Documents

Criminals copy real shipping documents, tweak details (like cargo value), and send them to banks. One steel exporter inflated 541 coils to 768 coils on paper—stealing millions overnight .

4. Back-to-Back LC Shell Games

A fraudster uses one LC from Bank A as “collateral” to get a second LC from Bank B—hiding links to sanctioned countries or fake suppliers .

5. Rusty Steel? Just Erase It!

Exporters bribe port agents to issue “clean” bills for damaged goods (e.g., rusted steel). Banks pay because documents seem compliant—until the buyer receives junk .

### 🛡️ How We Fight Back: Smarter, Inclusive Tech

– Blockchain Bills of Lading: Digital records that can’t be faked or duplicated .

– LEI (Legal Entity Identifier): Like a “business fingerprint” to verify who’s who globally 🌍 .

– Collaborative Databases: Banks share fraud alerts without exposing client data (e.g., Singapore’s Trade Finance Registry) .

💡 The Future? Open-source AML tools and shared regtech (like #InclusiveRegtech) let even small banks access anti-fraud tech—closing gaps criminals exploit!

### 💬 Your Turn

Have you seen LC fraud in action? Share below! 👇 Let’s make finance safer together.

🔗 Source: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

✨ P.S. Like this? I write daily on anti-financial crime for #100HariNulis. Follow me!

#TradeFinance #FinancialCrime #AML #Regtech #OpenSourceAML #InclusiveRegtech #SupplyChain #FraudPrevention #Banking #Compliance