#QuickbiteCompliance day 257

🚨 The “Invisible Money” Trick: How Criminals Hide in Plain Sight

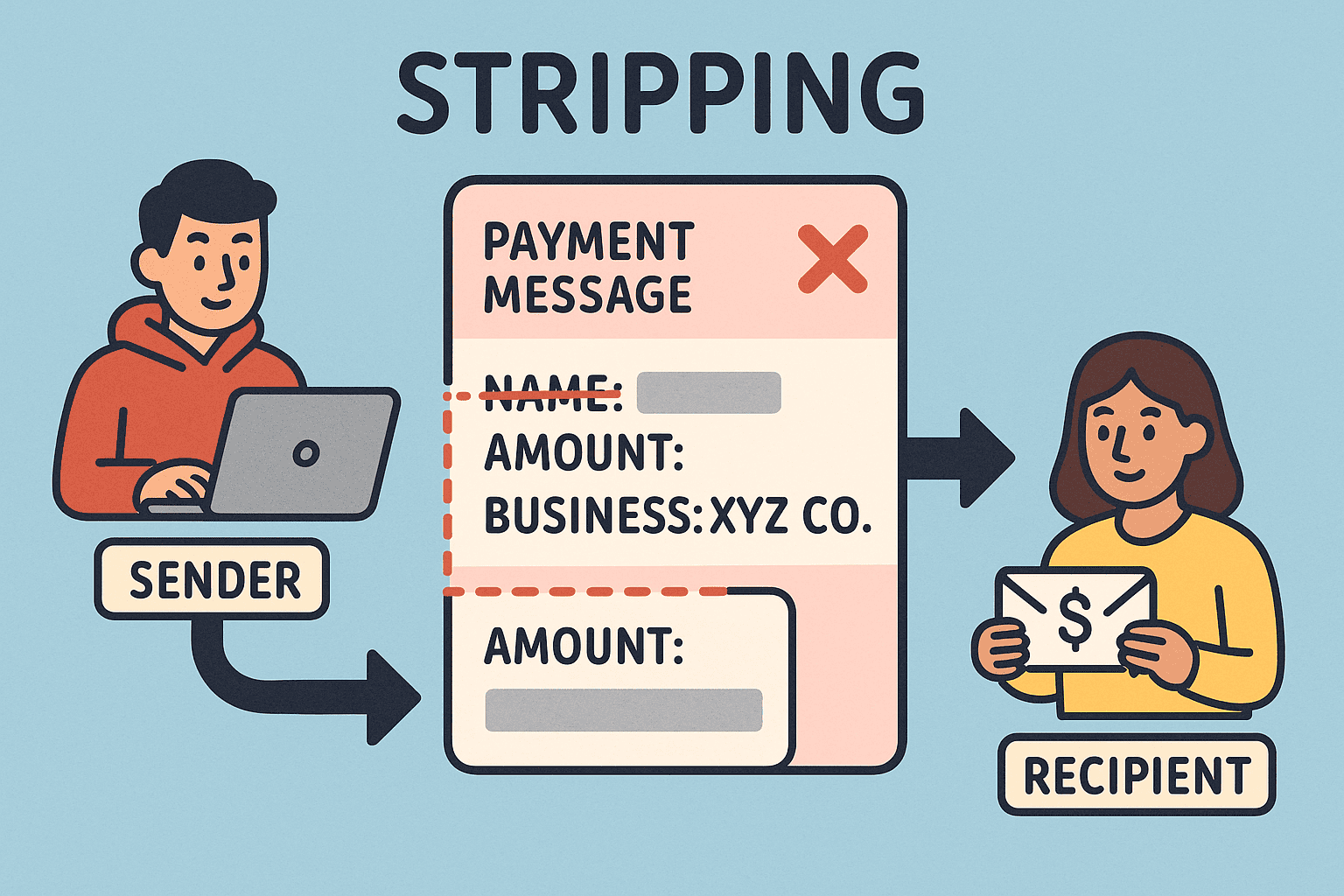

Imagine sending a secret message where you remove the sender’s name and address so no one knows where it came from. That’s “Stripping”—a sneaky way bad guys move dirty money across borders 🌍💸. Here’s how it works:

—

### 🔍 The Candy Smuggler Example (For Kids!)

1. The Problem:

– Little Ana in Country X wants to send stolen candy 🍫 to her friend Ben in Country Y.

– But Country Y bans candy from Country X!

2. The Trick:

– Ana first sends the candy to Charlie in Country Z.

– Charlie removes Ana’s name from the box and writes his own.

– Now the candy enters Country Y “from Charlie”—and no one knows it’s really from Ana!

👉 Real-world version: Criminals strip names of sanctioned people/businesses from wire transfers so banks won’t block them .

—

### ⚠️ Why This Hurts Everyone

– Stripped wires fund terrorism, drugs, and trafficking .

– Banks face $18 BILLION+ in fines for missing these tricks .

– You pay the price: Higher bank fees, less safe communities 😔.

—

### 🛡️ Fighting Back: Tech to the Rescue!

New tools are making stripping harder:

– AI Detectives: Algorithms spot “edited” payments by comparing past transactions (e.g., “Why did this $1M wire from Dubai suddenly hide the sender’s details?) .

– Global teamwork: Laws now force banks to share cleaner data 🕵️♂️🌐 .

– #InclusiveRegtech: Affordable tools help small banks catch stripped wires—not just Wall Street giants.

– #OpenSourceAML: Transparent tech lets everyone improve anti-crime systems (no more “black boxes”)!

—

### 💡 Your Power? Stay Curious!

Ask your bank: “How do you screen for stripped payments?”

The more we demand transparency, the harder we make it for criminals 🙌.

Source: [ACAMS Glossary of Terms](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #Stripping #AML #Sanctions #InclusiveRegtech #OpenSourceAML #100HariNulis #AntiMoneyLaundering #Fintech #StaySafe