Category: Terms

-

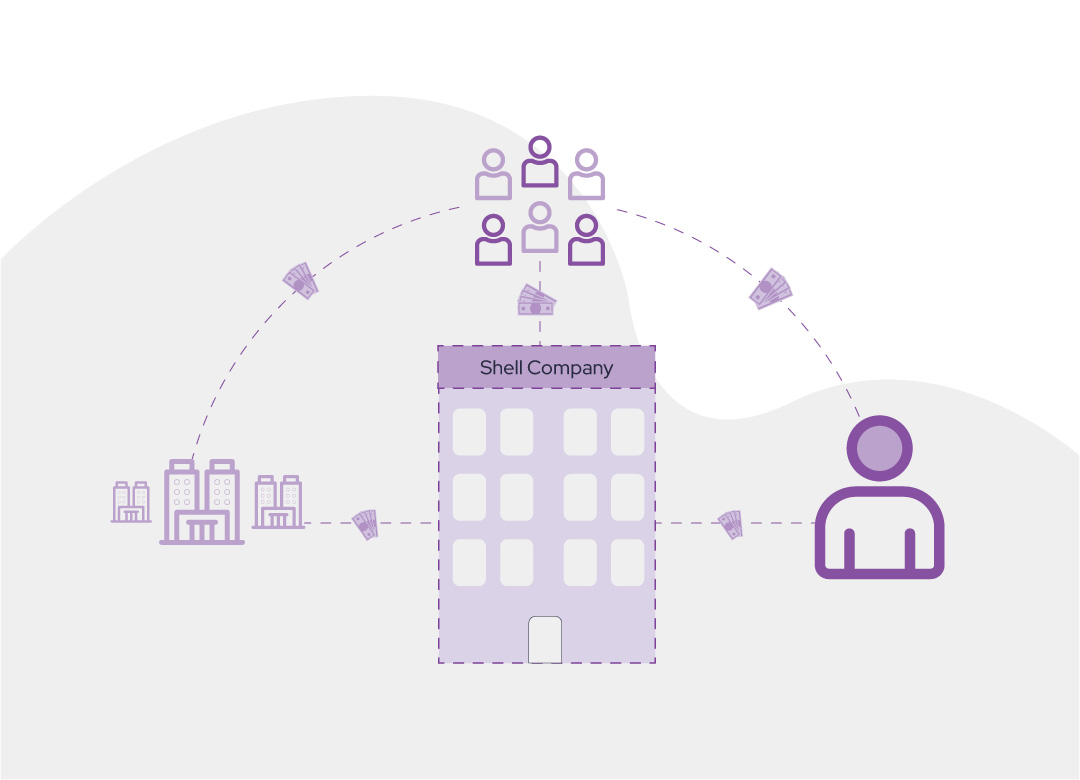

Day 246: Shell Company

#QuickbiteCompliance day 246 Unmasking the Magic Trick of Dirty Money: Shell Companies Explained! ✨ Imagine a magician making a coin disappear—but instead of a coin, it’s illegal cash! 🪙💸 That’s what criminals do with shell companies: businesses that look real but are empty “shells” (no office, no employees, no real work!). They’re legal but can…

-

Day 245: Shell Bank

#QuickbiteCompliance day 245 🚨 The Invisible Bank Heist: How “Ghost Banks” Fuel Global Crime 🚨 Imagine a bank with no building, no tellers, and no ATMs—just a name on paper. That’s a #ShellBank: a ghost institution hiding in plain sight, often in offshore havens with lax rules. While legitimate banks have branches, these “paper-only” entities…

-

Day 244: Shelf Company

#QuickbiteCompliance day 244 🚀 Shelf Companies: The “Instant Business” That Can Hide Big Problems! You know how some people buy pre-made cakes at the bakery? Well, shelf companies are like pre-made businesses! They’re created months or years in advance (often by law firms), then sit “on the shelf” until sold. Buyers get a “clean” business…

-

Day 243: Sham Divestment

#QuickbiteCompliance day 243 🚨 Breaking Down “Sham Divestment”: The Invisible Trick Hiding Dirty Money 🕵️♂️ Imagine a game of hide-and-seek where the hider pretends to leave but stays in control. That’s Sham Divestment—a sneaky move used by sanctions targets (like corrupt leaders or criminals) to “sell” assets to friends, family, or allies. On paper, the…

-

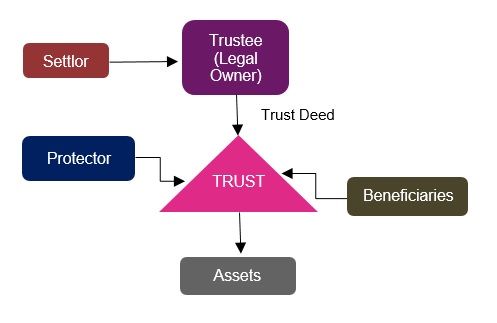

Day 242: Settlors

#QuickbiteCompliance day 242 ### 🏦 Trusts: The Treasure Chests with a Secret Map… and How Pirates Hijack Them! Imagine giving your treasure chest to a trusted friend (a “trustee”) with instructions to share it wisely. You might add a wish list (a “letter of wishes”) suggesting who gets what—like “save some for Timmy’s college fund!”…

-

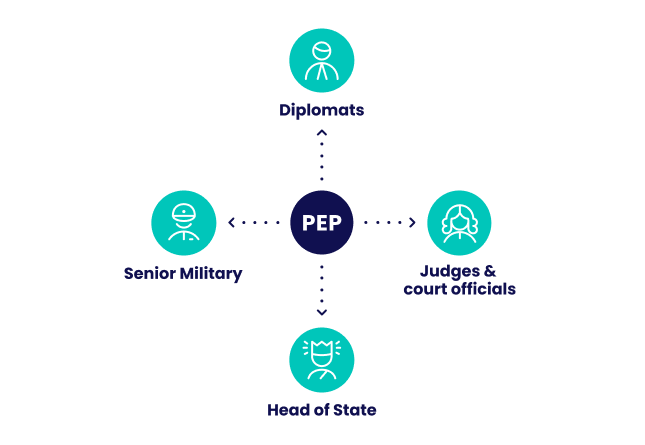

Day 241: Senior Foreign Political Figure

#QuickbiteCompliance day 241 🔍 Keeping Up with the “Big Cheese” from Other Countries: How Bad Guys Use Power to Steal Money! Hey everyone! Let’s talk about Senior Foreign Political Figures (SFPFs)—a fancy U.S. term for powerful people in other countries, like presidents, ministers, or generals. These folks aren’t bad by default, but their power makes…

-

Day 240: Selective Sanctions

#Quickbitecompliance day 240 🚨 How “Selective Sanctions” Help Catch Bad Guys (And How They Try to Cheat!) 🚨 Did you know countries sometimes freeze only the money of bad guys—not whole countries? This is called #SelectiveSanctions or #TargetedSanctions. It’s like taking away a villain’s magic wand instead of destroying the whole kingdom! But guess what?…

-

Day 239: Seized

#QuickbiteCompliance day 239 🚨 The Candy Bar Heist: How Cops “Seize” Bad Guys’ Loot! Imagine your principal catches a kid stealing candy bars. Instead of just freezing the candy (saying, “Don’t eat it yet!”), she SEIZES it—grabbing the bars and locking them in her desk. The candy still belongs to the kid, but now the…

-

Day 238: Sector Sanction Identification List (SSI List)

#QuickbiteCompliance day 238 🚨 Understanding the SSI List: How Sanctions Help Stop Financial Crime 🚨 Did you know there’s a special list called the Sectoral Sanctions Identification (SSI) List? It’s different from the SDN List (which blocks all dealings with bad actors). The SSI List only restricts certain sectors—like energy or finance—to weaken rogue regimes…

-

Day 237: Sectoral Sanctions

#QuickbiteCompliance day 237 🚀 Sectoral Sanctions: A Smarter Way to Stop Financial Crime? Did you know there’s a type of financial restriction that doesn’t just block one person or one company—but an entire sector of a country’s economy? It’s called #SectoralSanctions, and it’s like putting a “Do Not Enter” sign on certain money moves with…