#QuickbiteCompliance day 275

🚨 Hidden in Plain Sight: The “Alphabet Trick” Fueling Financial Crime!

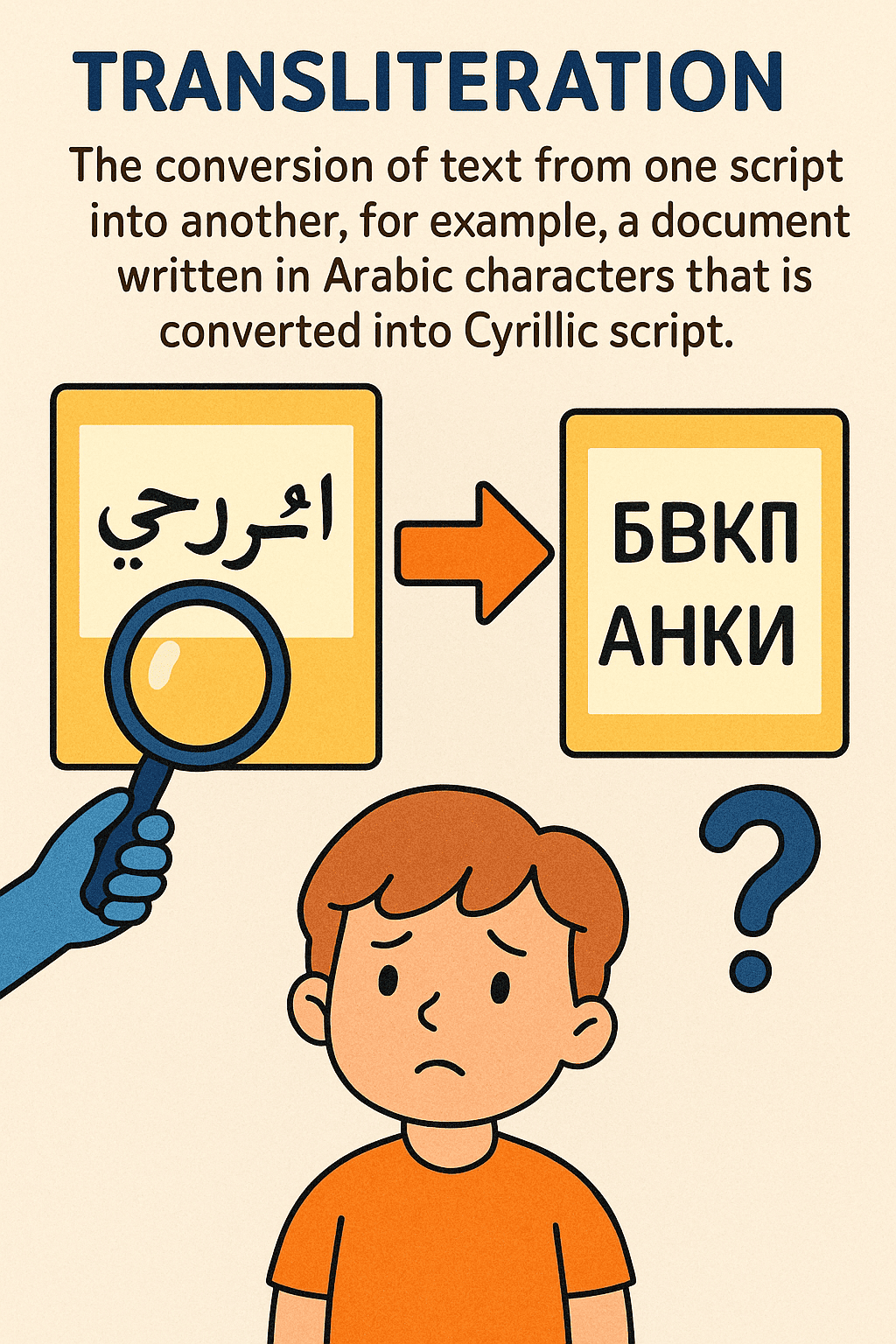

Imagine your name changing spelling every time you cross a border. “Mohammed” becomes “Muhamad,” “Muhammad,” or “Mehmet” 🌍➡️🇷🇺➡️🇨🇳. This isn’t magic—it’s #Transliteration (converting text between scripts, like Arabic to Cyrillic). While it helps global communication, criminals exploit it to hide dirty money.

🔍 How Bad Guys Game the System:

1️⃣ Fake IDs: A terrorist uses “علي” (Arabic) on one passport and “Али” (Cyrillic) on another. Screening systems see them as different people!

2️⃣ Sanctions Dodging: Sanctioned “Vladimir Petrov” (Cyrillic: Владимир Петров) sends money as “Vladymyr Petroff” (Latin)—fooling banks that can’t connect the dots.

3️⃣ Synthetic Identities: Criminals blend real & fake data to create “Frankenstein” names (e.g., Chinese + Arabic transliterations) to open accounts for laundering.

💡 The Fix? Smarter Tech!

Rules-based systems fail with script variations. Next-gen tools like #InclusiveRegtech use:

✅ AI-driven script-agnostic matching (spotting “محمد” = “Mohammed” = “Мухаммед”).

✅ Open-source algorithms that learn global naming patterns—no more “alphabet blind spots.”

✅ Collaborative networks where banks share anonymized transliteration risks (e.g., “Xin” in Mandarin vs. Serbian!).

🌐 Why It Matters:

1 in 3 false positives in AML stems from name mismatches 💸. Embracing #OpenSourceAML isn’t just tech—it’s inclusion. It helps systems understand Ali, Али, and علي are the same person… and stops criminals hiding in the script shuffle.

👉 Swipe left to see how Mulai Console tackles this with #InclusiveRegtech!

[ACAMS Glossary: Transliteration](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #AML #Sanctions #FinTech #RegTech #100HariNulis #AntiMoneyLaundering #NameScreening #GlobalCompliance

—

💬 Discussion Prompt: Have you seen transliteration gaps cause compliance headaches? Share below!