#QuickbiteCompliance day 274

🚨 Stop the Money Trail: How Criminals Exploit Banking Systems & How We Catch Them

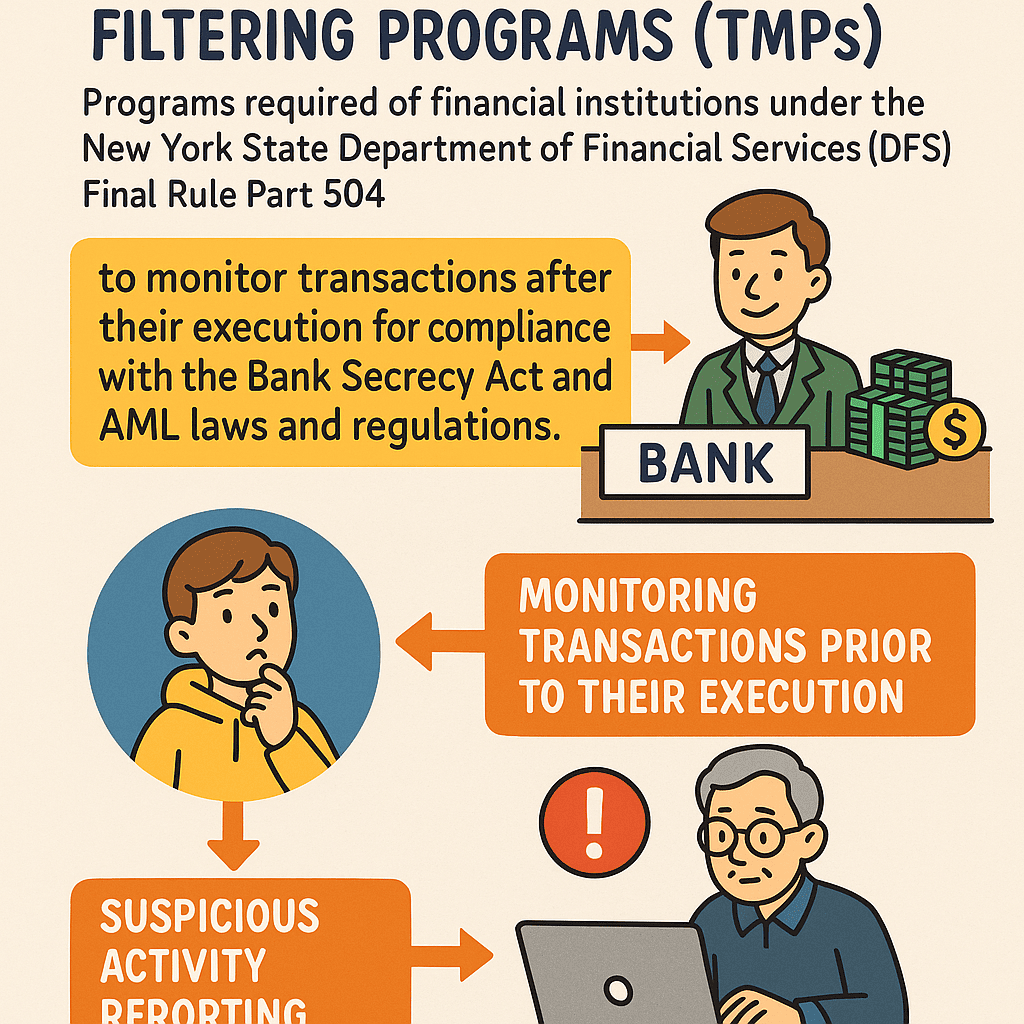

Imagine your bank account is a piggy bank. Now imagine bad guys trying to sneak dirty money into it, then move it around like a shell game until it looks clean. That’s financial crime. And Transaction Monitoring & Filtering Programs (TMPs) are the alarm systems banks use to catch them.

🔍 In Simple Terms:

TMPs are like super-smart guards that:

1️⃣ Watch money moving in/out of accounts after transactions happen (e.g., $10,000 cash deposits every Friday).

2️⃣ Block dirty money before it moves (e.g., stopping payments to a terrorist group).

New York’s DFS Part 504 Rule requires banks to have these guards in place—or face massive fines 🚨 .

😎 How Criminals Trick the System:

Bad guys get creative. Here’s how they’ve slipped past weak TMPs:

– The Dark Web Drug Market:

Criminals used crypto wallets linked to sites like Hydra Market to move $5 billion in drug money. They broke transactions into small amounts to avoid detection—until a TMP spotted odd patterns .

– The Fake Pill Factory:

A China-based vendor sold deadly fentanyl materials to U.S. buyers. They used “structuring”—sending payments just below $5,000 thresholds—to fly under the radar. TMPs caught the repetitive transfers .

– The North Korean Hackers:

The Lazarus Group stole crypto, then swapped it across 20+ wallets using privacy coins (Monero). TMPs using blockchain analytics flagged the rapid hops .

🛡️ Fighting Back Smarter:

The rule isn’t just about compliance—it’s about collaboration. Banks now share:

– Better tech (like AI that learns crime patterns).

– Open-source tools (so small banks access big-bank defenses 💡).

– Global SAR databases (tagging suspicious activity across borders) .

💡 The Future is Inclusive:

Regtech shouldn’t be a luxury. When tools are open-source and accessible, even community banks can shut down money launderers—making the whole system safer 🌍.

👉 REPOST if you believe tech + teamwork = safer finance!

______________________________________________

📚 Dive deeper: [AML Glossary of Terms](https://www.acams.org/en/resources/aml-glossary-of-terms)

🔗 Learn about #InclusiveRegtech & #OpenSourceAML—democratizing compliance.

#TransactionMonitoring #AML #FinancialCrime #NYDFS #FinTech #RegTech #100HariNulis #Compliance