#QuickbiteCompliance day 272

🔍 Toll Gates & Payment Chains: How Criminals Sneak Past the Guards!

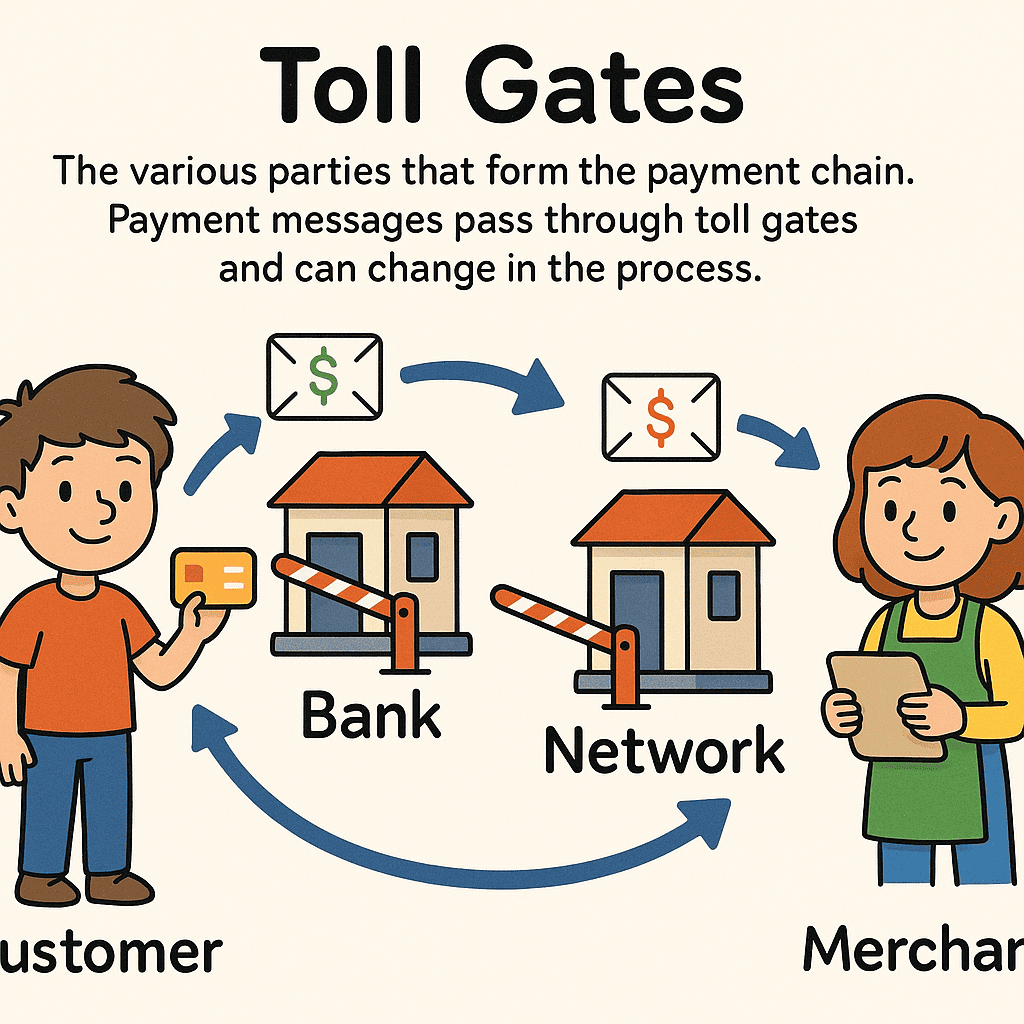

Imagine passing a note in class: you write “Pizza Party Friday!” 🍕 But by the time it reaches the last kid, it says “No Homework Monday!” ✏️➡️📝 How? Each kid (like a “toll gate”) changes the message slightly. Payment chains work the same way! Money messages zip through banks, apps, and processors—each one a “toll gate” that can tweak the info. Bad guys love this chaos!

—

### 🕵️ How Criminals Exploit Toll Gates

1. The “Smishing” Scam

– You get a fake text: “Pay $3.50 for unpaid tolls! Click HERE!” 🚗💨

– Clicking it sends your bank details through shady toll gates (hackers), who steal your money .

2. The “Layering” Trick

– Dirty cash moves through 10+ toll gates (banks, crypto apps, shell companies).

– Each gate changes the payment message (e.g., “Business loan” → “Art sale”), hiding the crime trail .

3. The “Ghost Toll Booth”

– Crooks set up fake payment processors (toll gates) that “lose” transaction details.

– Example: A scammer in India hacked real toll plazas, diverting $45,000/day into private accounts! .

—

### 🛡️ Fighting Back: Smarter Toll Gates!

– #InclusiveRegTech: Tools like Mulai Console give every bank—even tiny ones—open-source tech to spot fake toll gates. Think “neighborhood watch” for payments! 🌐 .

– #OpenSourceAML: Free code libraries help toll gates “talk” to each other, so money messages can’t be secretly changed. Like a group chat where everyone sees the edits! 💬 .

—

💡 Key Takeaway: Toll gates aren’t bad—but when they’re broken, criminals win. With open tech, we can build gates that protect instead of leak!

🔗 Learn terms like layering, smishing, and shell companies: [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #AML #Payments #RegTech #InclusiveRegtech #OpenSourceAML #100HariNulis #TollScam #FraudPrevention #FollowTheMoney

—

P.S. Ever seen a payment “change clothes” mid-journey? Share below! 👇