#QuickbiteCompliance day 271

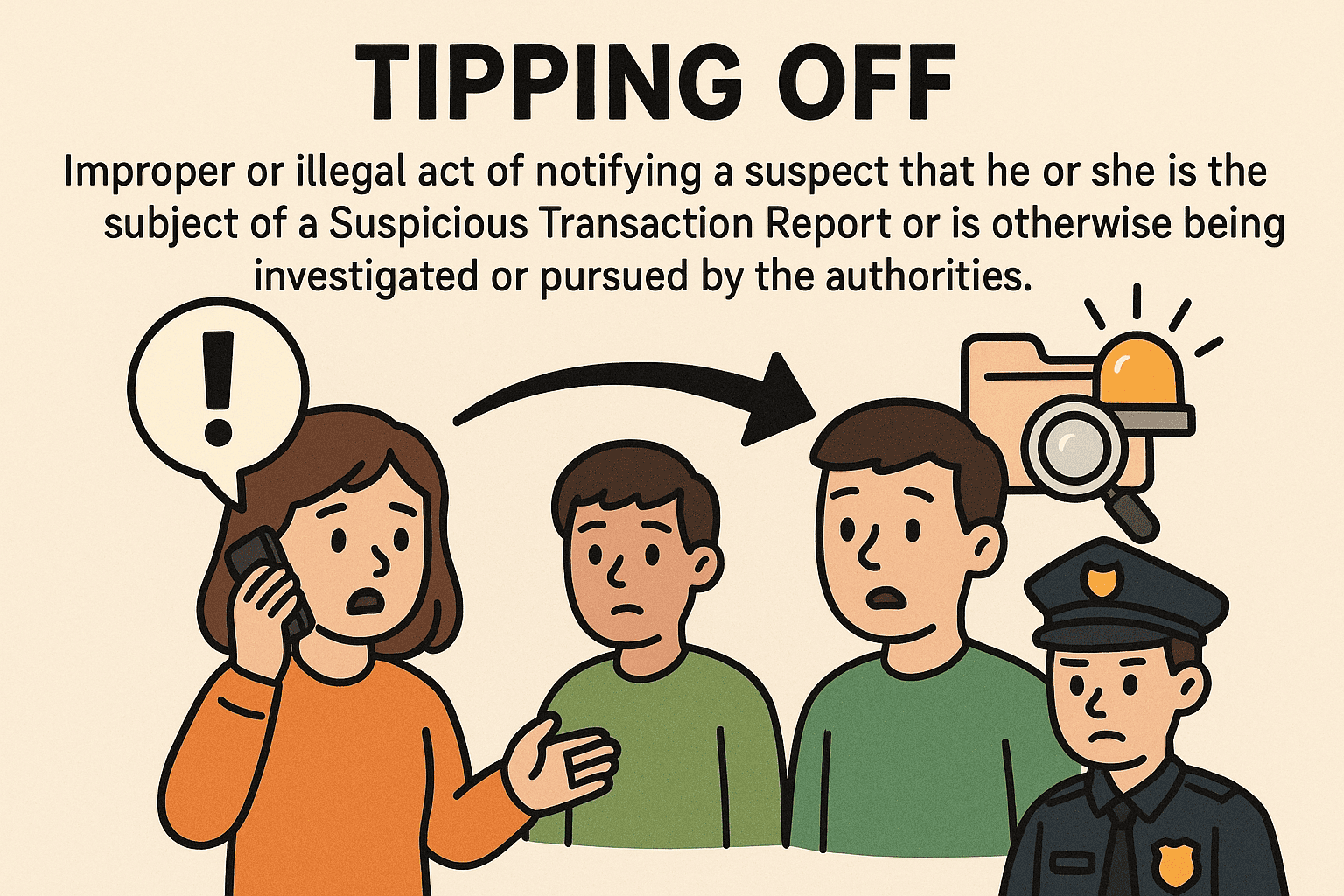

🚨 Imagine playing hide-and-seek, but someone whispers: “The seeker is coming! Hide better!” That’s “tipping off” in financial crime—and it helps BAD GUYS win. Here’s how:

### 🔍 Simple Breakdown

1. What is Tipping Off?

– Telling a suspect, “Psst… the cops are onto you!” 🗣️

– Example: A banker warns a customer about a secret Suspicious Transaction Report (STR) .

2. How Do Criminals Exploit It?

– ⚡ Vanishing Acts: Dirty money disappears instantly when tipped off.

Real case: Drug cartels move cash through “isolation companies” before investigators react .

– 🎭 Fake Identities: Scammers swap IDs like costumes.

Tipping them off? They’ll burn evidence and reappear as “someone else” .

– 🕵️ Stall Tactics: “Your transaction is pending…”

Criminals use delays to reroute funds .

### 💥 Why It Hurts Everyone

– Fines: Banks pay millions for accidental leaks .

– Crime Grows: Terror funding, scams, and trafficking thrive in secrecy .

### 🛡️ Fight Smarter!

– Tech to the Rescue: AI tools scan global sanctions lists in seconds, spotting hidden links humans miss .

– Stay Silent: Never hint at investigations—even by asking “odd” questions .

– Train Teams: Teach staff to say, “We need more paperwork,” not “We’re filing an STR” .

> 🌟 Key Insight: Tipping off isn’t just illegal—it’s a get-out-of-jail-free card for criminals.

#InclusiveRegtech and #OpenSourceAML (like Mulai Console) help even small banks access crime-fighting tech—no $$$$ software needed! Let’s close loopholes together 🤝

🔗 Learn more: [ACAMS AML Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#FinancialCrime #AML #TippingOff #RegTech #Compliance #100HariNulis

—

💡 P.S. Spot a red flag? Report it CONFIDENTLY. Silence saves lives.