#QuickBiteCompliance Day 201

🚀 Let’s Talk About Payment Screening! 🚀

Imagine you’re playing a game where you have to spot fake treasure maps before pirates sneak them past you. Payment screening is like that—but for banks! It helps catch sneaky transactions before they go through, using clues hidden in payment messages. 💸

How do bad guys cheat the system?

1. Fake Descriptions: A criminal sends money labeled “consulting fees” to hide bribes. The payment template says it’s “legal,” but it’s really dirty cash!

2. Code Tricks: They use innocent-looking codes like “LOAN” to move stolen money. The bank sees “LOAN” and thinks it’s safe… but it’s not!

3. Sneaky Splitting: Break $1 million into 100 small payments labeled “gifts.” Tiny amounts fly under the radar!

4. Secret Acronyms: “TXL” might mean “tax loan” to the bank but actually stands for “trafficking funds” to criminals. 😱

Why does this matter?

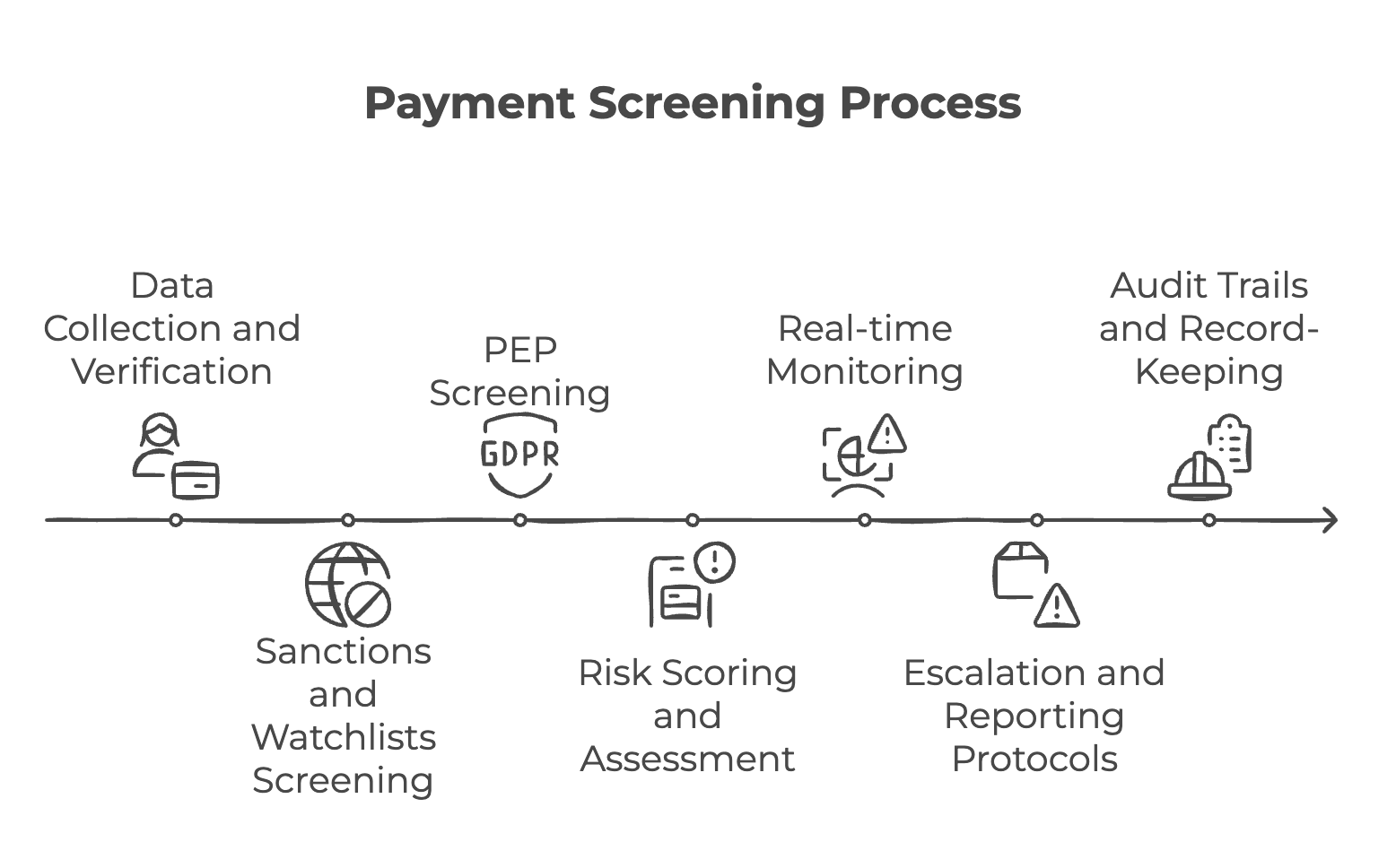

Payment screening checks every transaction like a detective with a magnifying glass 🔍, even for trusted customers. But since banks can’t control how third parties label payments (like “LOAN” or “TXL”), they need smart tools to spot lies hidden in plain sight.

Together, we can build safer systems! 💪

Check out the ACAMS glossary to learn more about fighting financial crime:

👉 [ACAMS Glossary](https://www.acams.org/en/resources/aml-glossary-of-terms)

#InclusiveRegtech #OpenSourceAML #100HariNulis #StopFinancialCrime #PaymentScreening

—

P.S. Inclusive tech and open-source tools are key to making AML efforts fairer and stronger. Let’s keep the conversation going! 🌍